There are various of medical card you may get from the market. It is quite hard for us to define which is the best and a lot of marketing advertisement to attract us. We may get misleading information if we unable to understand truthfully without reading the policy contract. Let’s go through some of the basic terms that you have to understand before you go into decision making on which medical card suits you.

Why i take Medical Card?

Before we go into the basic terms, let’s us talk about reason of taking it. Medical Card coverage is important for you when special hospitalization care needed such as surgical, admitted, special care in ICU and etc. It might get handy if you have medical card on hand when you admitted to private hospitals. Mostly their medical cost of 1 admission is minimum RM 2,000 above (1 night stay), up to no limitation if surgical required.

Due to the high medical inflation, it is important for us to get ready of medical coverage before it is too late. There are increase of 13% on medical inflation that making Malaysian unable to afford the medical cost of private hospitals. Cost of insurance of medical card is increasing year by year, Malaysia insurance companies are revise their premium upwards due to the inflation of medical cost.

Insurance companies may reasonably price an inflation rate of six to eight percent to cover medical inflation. However, with Malaysia having experienced one of the highest medical inflation rates in the Asean region in recent years, the expected increase in medical claims for 2019 was 13%. As a result, insurance companies have had to revise their premiums upwards.

Source: The Stars, High medical costs explained, 12 Feb 2020.

https://www.thestar.com.my/opinion/letters/2020/02/12/high-medical-costs-explained

I already have Cooperate Medical Card, why should I have personal medical card?

You might thinking why i should have a Medical Card if i have Cooperate Medical Card? Do you notice that your cooperate medical card will only cover you while you are still working? Mostly they are only cover you up to age 60. After that you are on the risk of zero medical card, and have no choice because at the age of 60, the premium of insurance is quite high compared to when you buy at younger ages. Either you afford it, or you stay healthy while your golden ages. It is better to get your personal medical card especially at younger age. Mostly average people will start worry when the age of 40 to get their medical card.

Basic Terms to Understand in Medical Card

R&B 200 / Annual Limit 1,500,000 / Lifetime Limit Unlimited (Age 100)

1. Room & Board (R&B)

This is consist of which Room & Board you will get when you using your medical card. There are various of packages of this and please aware that there are limitation on how many days you will get covered. in a policy year. Standard of days is 120 days, which is normally we will feel comfort about. Room & Board selection such as 100, 120, 150, 200, 300, 400 & 500. We will recommended you at least have a 150 Room & Board (Year 2020) to have shared room for your hospitalization needs.

2. Annual Limit

The purpose of Annual limit is to claim your hospitalisation bills and follow ups. If you exceeded the limit of your claim for that year, you may need to wait till the next policy year to get refreshed annual limit. It is depends on your lifetime limit as well, if your whole life limit has a limit, you may need to monitor the usage of your limit to ensure it is sufficient. We encourage you to take at least RM 100,000 for your annual limit to ensure at least a backup in case unfortunate event happen. The best is to get RM 1,000,000 annual limit above to ensure there are no limitation when things happen. Currently Million Dollar Medical Card is affordable compared to years back before.

3. Lifetime Limit

Whole life limit is limit for your medical card to use for the rest of the coverage period. Please take note on this, if your medical card is low premium, there might have a limit on your lifetime limit. Low lifetime limit may cause serious problem when claim.

Example: Unfortunately I have diagnosed with Cancer that cost me about RM 100,000 for my surgical and admission bills, and continuously 2nd year having follow up and Chemotherapy, costed me around RM 200,000. I just found out my lifetime limit is only at RM 200,000. In this case, I have exhaust my lifetime limit, and I have to top up cash from my own pocket to settle the medical bills.

Mostly this will happen for those insured that bought the medical for the past 10-15 years above. At that time, market still selling limited lifetime limit medical card, which is at the rage of RM 100,000 to RM 300,000 lifetime.

4. Age

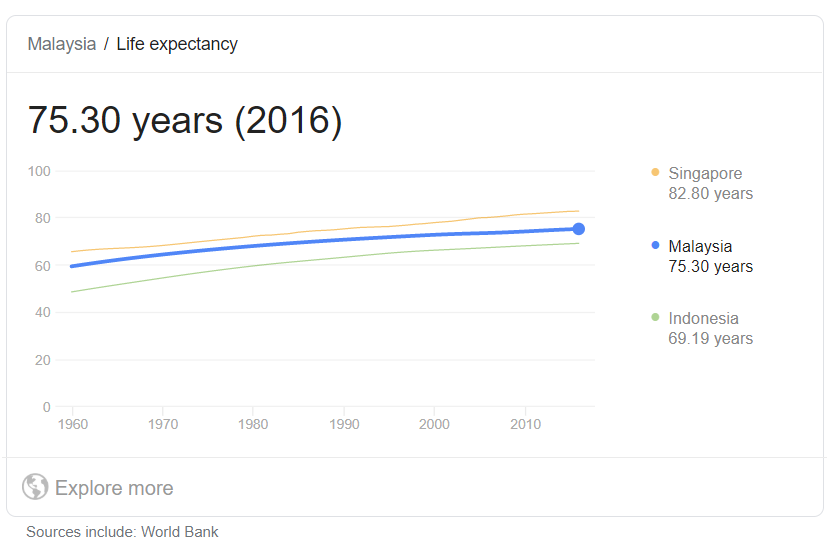

You might notice that medical card has a coverage of age limit, in the marketing currently mostly applies coverage up to age 70, age 80 and age 100. There are old medical card that covers until age 65 only. Age limit is very important for you to plan your retirement age. If your health is good and having a longer life, age 70 might not enough for you. Based on statistic shown from World Bank, Malaysia’s average lifespan is at age 75.30. It will be secure if you choose the age coverage limit at age 80.

For more in-dept information about medical card, please visit post link as below:

Medical Card: Standalone or Rider?

http://ckpartners2u.com/2020/03/medical-card-standalone-or-rider/